Credit Card Applicant Approval Prediction

Background

In response to the dynamic landscape of Indonesia's rapidly

expanding credit card market, our team has initiated a significant

data-driven endeavor titled "Credit Card Applicant Approval

Prediction" This project marks the pinnacle of our Proof of Concept

(PoC) effort as part of Data Fellowship 10 IYKRA.

Indonesia's credit card market has displayed remarkable growth over

the past five years, reaching an impressive valuation of IDR 4.43

Trillion. Within this rapidly evolving market, our organization

holds a substantial 30% market share. In 2022, the approval rate for

credit card applications reached 27.1%, resulting in the approval of

4.25 million new credit cards. Projections for 2023 suggest

a potential 19.1 million new credit card approvals.

However, the context surrounding credit card approvals is far from

straightforward. A significant concern is

the estimated 5% of potential losses attributed to

fraudulent or unqualified applicants. It is imperative for our

organization to secure its market position and comply with evolving

Personal Data Protection (PDP) regulations.

Objective

In response to these challenges, our objective is crystal clear: to

design an end-to-end data pipeline solution that significantly

enhances the accuracy of credit card approval predictions. We intend

to harness the power of scalable data architecture, which, in turn,

will empower our Data Scientists and Machine Learning Engineers to

operate with maximum efficiency.

Our primary goal is to

ensure that only genuinely qualified applicants are approved for

credit cards , thereby minimizing potential losses and reinforcing our market

presence. Simultaneously, we are committed to upholding the

strictest standards of data privacy and protection, in alignment

with the prevailing PDP regulations.

Data Architecture and Dashboard

To achieve this objective, we have constructed a sophisticated data architecture. This architecture is designed to integrate and process data efficiently, yielding the necessary insights for more accurate credit card approval predictions. We employ various technologies and tools, including cloud-based data processing, to ensure scalability and security in managing sensitive data.

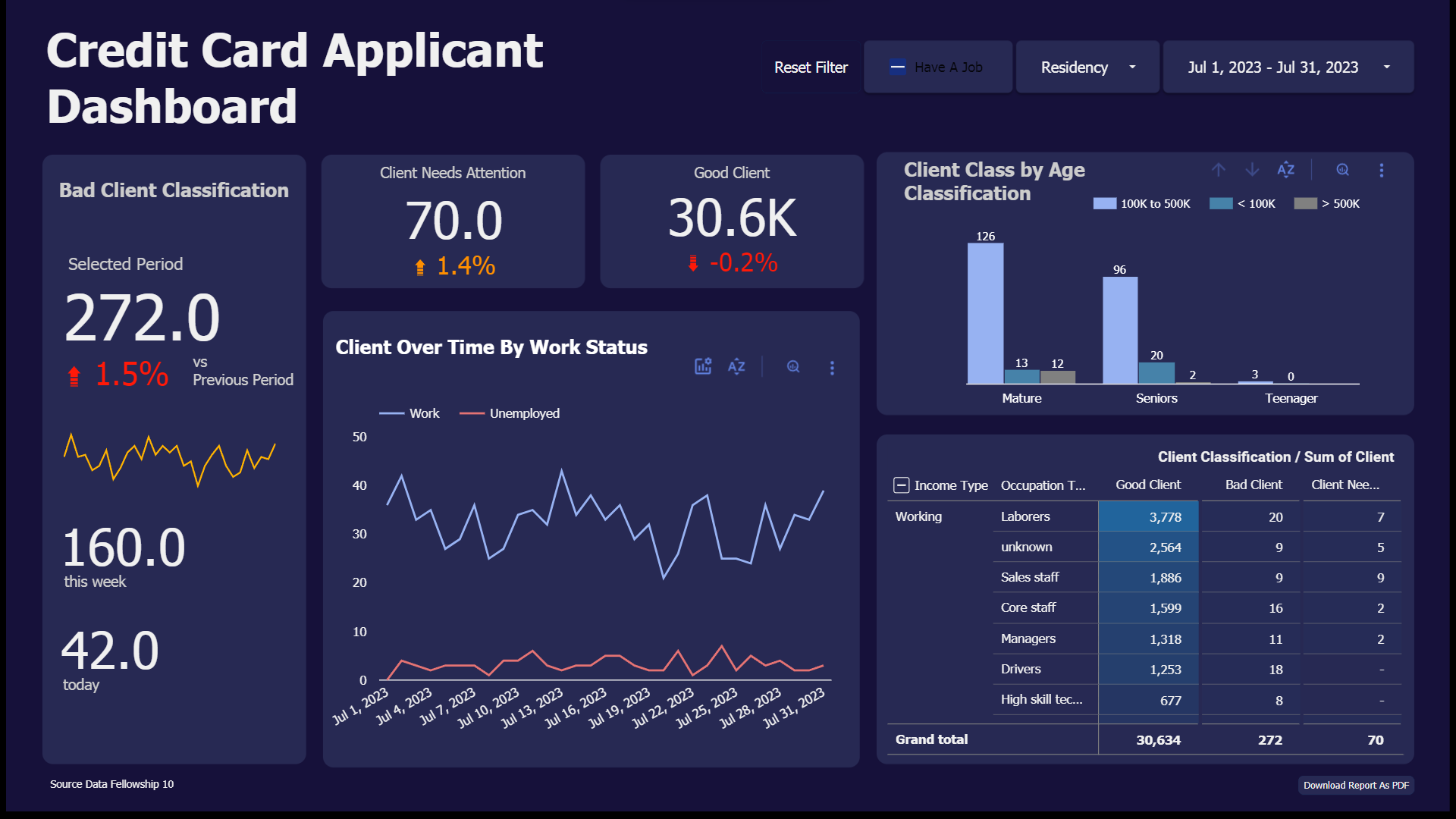

Furthermore, we have developed an analysis dashboard, serving as a vital monitoring tool. This dashboard enables our team to real-time track the progress of credit card approvals, monitor the performance of prediction models, and gain valuable insights. With this dashboard, we can take proactive actions to minimize risks and enhance the efficiency of the approval process.

This project represents our commitment to harness data technology to achieve better credit card approval predictions, maintain a strong market position, and comply with data protection regulations. Through efficient data architecture and analysis dashboard, we provide a reliable and secure solution to support the growth and success of our business.

Infrastructure Presentation

For a comprehensive understanding of our data infrastructure and the technologies used, we have created a presentation slide deck below. This presentation includes detailed information about the technology stack employed, as well as an overview of the dashboard that has been developed.

Through this presentation, you will gain a deeper insight into the intricacies of our data architecture, ensuring transparency and clarity in our approach to achieving better credit card approval predictions.

Access The Dashboard

If you would like to access the dashboard directly and witness our credit card approval prediction system in action, please click on the following link: Dashboard. This link will provide you with real-time access to our dashboard, allowing you to explore the functionality and insights it offers. We welcome you to experience firsthand the power of our data-driven solution.